Navigating the Dangers: How Hackers Exploit Bank Account Credentials

- Jesus Vicente & Robyn Sibal

- Aug 28, 2024

- 4 min read

Updated: Sep 8, 2025

How Hackers Exploit Bank Account Credentials

There has been an increase in cyber-attacks on bank account credentials. Anything from stolen checks to hacking to phishing scams. These tactics are leading to financial and security losses for individuals and businesses. Recent statistics have shown that 71% of all data breaches are financially motivated and that 92% of ATMs are vulnerable to attacks. Banks, businesses, and individuals are constantly at risk for hacking and credential leaking, so it is important to know common hacking tactics and preventative measures.

Common Hacking Tactics

There are quite a few common hacking tactics to be aware of when it comes to how hackers achieve access to bank account credentials. These methods commonly exploit human error and security vulnerability, making it essential to know the following common hacking tactics used against businesses and individuals:

Credential-Stuffing

Credential-stuffing involves using stolen usernames and passwords from one website to access other accounts. This is an effective way hackers gain access to banking credentials due to the human nature of using the same credentials across multiple websites or account types. According to Meta Compliance, the FBI reported that 41% of financial sector cyberattacks in the past three years were due to stolen credentials (credential stuffing).

The volume of data breaches exposes countless usernames and passwords, providing a large source of credentials for hackers to try and use across different websites.

Due to advanced technologies like AI, the efficiency of credential-stuffing attacks has improved substantially. Automated tools allow hackers to test stolen credentials across multiple websites and platforms, which increases the chance of successful access.

Phishing Scams

Phishing scams are a very common method for many types of hacking. These scams can be done through email, texts, phone calls, and more. These hackers are often posing as reps from financial institutions. Most banks and other financial institutions inform customers that they will never contact them and ask for confidential over the phone or email. Customers should only speak to reps through reputable sources, like official contact numbers or chatbots embedded on the website.

Malware

Malware is malicious software designed to infect and damage computer systems. Hackers often use this type of software to gain access to bank accounts and other financial credentials by capturing screenshots, recording keystrokes, or by exploiting other security vulnerabilities. Hackers can use these methods to steal bank account passwords and drain bank accounts completely. By using malware, hackers can gain access to all of your accounts so ensure you have proper safety protocols.

Social Engineering Attacks

Social engineering attacks are another malicious way hackers and cyber criminals can gain access to your bank account credentials. Along with phishing scams, social engineering attacks involve the impersonation of trustworthy sources and employees to gain confidential information. These attacks can be done through social media, email, text messaging, phone calls, and other platforms.

After reaching out to potential victims, hackers begin to impersonate and lure victims in with a false sense of trust. When the hackers either gain access to the bank account or the credentials needed, they will suddenly cut contact, leaving victims confused and unsure of what to do next.

Other Tactics

Beyond the tactics mentioned above, there are a few more cybercriminals use to gain access to bank account credentials:

Man-in-the-Middle Attacks: These attacks involve monitoring untrusted servers and analyzing the information being sent and received. Hackers can also use this method to clone websites, tricking users into entering their login information into a fake website.

SIM Swapping Method: This hacking method allows hackers to take complete control over a victim's phone and gain access to their passwords and usernames that way.

Mobile Banking Trojans: These are fake banking apps that trick users into logging in by appearing as a copy or are completely unrelated apps that will infect your phone and look for saved passwords.

Preventative Measures

Now that you’ve learned the different hacking tactics for exploiting bank account credentials, it's time to look at the preventive measures you can take to protect yourself. Here are some simple things you can do to protect your confidential banking information:

Strong Passwords and Password Management

Establishing strong passwords and having effective password management can help keep you protected in the long run. Each password should be unique for each account, banking or otherwise. Implementing password management tools can help securely store passwords and generate complex passwords. These complex passwords and management systems can help safeguard all your banking information.

Two-Factor Authentication (2FA)

2FA is a great way to further protect any type of password, especially banking credentials. 2FA adds an effective extra layer and a second form of verification to any login. This second form of verification can include a code sent to your phone/email, answering security questions, or entering an extra PIN number. These additional steps can help prevent hackers from accessing your account information by adding layers of security that they cannot easily bypass.

Secure Browsing Habits

Practicing secure browsing habits entails avoiding suspicious links and ensuring the websites you visit are secure. Some other secure habits to develop include:

Blocking popups

Use an ad blocker

Enable ‘do not track’ on all browsers

Do not allowing websites to view your location

Keep antivirus software up to date

Regularly scan system for malware

Developing these safe browsing habits can keep your bank account credentials out of the hands of cybercriminals. These habits can also help protect all other confidential information, so start making these habits today.

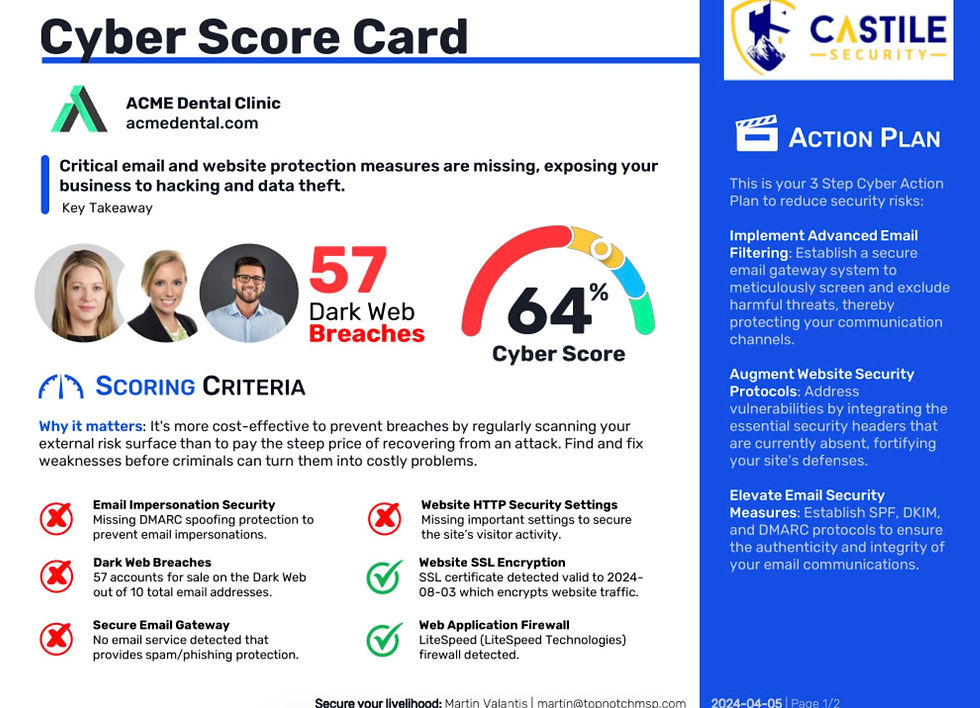

Impact on Businesses

The attack on banking account credentials heavily affects individuals and businesses. Businesses and banks can suffer from financial losses, damage to reputation, legal troubles, and more. These issues can affect businesses for a long time and can be tough to recover from. Bad press and upset customers can put a stop to business and expansion.

To avoid these issues, businesses and bank must prioritize cybersecurity on all ends. This involves implementing strong security measures, educating all employees about cybersecurity best practices, and regularly reviewing and updating security systems to stay ahead of new threats. By taking proactive steps to protect bank account credentials, businesses can reduce the likelihood of exploitation and ensure their long-term stability and success with customers.

Many larger businesses and banks hire an external cybersecurity company to handle all protection services. This can be helpful if a business does not have the appropriate time and resources to allocate to the best cybersecurity practices. Castile Security can help monitor and secure your business. Schedule a call today!

Comments